Occupy Wall Street, Jesse Ventura, Rick Perry, Mike Bloomberg and Matt Taibbi

Occupy Wall Street, Jesse Ventura, Rick Perry, Mike Bloomberg and Matt Taibbi

I had the pleasure recently of taking a break from the nightlife of Soho and attend Occupy Wall Street.

Taibbi on Imus: Occupy Wall Street

Click Here for Zippo Lighter Armor Brushed Sterling Silver

JESSE VENTURA ATTENDS OCCUPY PROTEST

Click Here for Zippo Lighter Vintage, Sterling Silver, High Polish

Rick Perry: The Best Little Whore In Texas

Early morning in a nearly filled corporate ballroom at the Cobb Energy Centre, a second-tier event stadium on the outskirts of Atlanta. It’s late September, and a local conservative think tank is hosting a get-together with Rick Perry, whose front-runner comet at the time is still just slightly visible in the bottom of the sky. I’ve put away five cups of coffee trying to stay awake through a series of monotonous speeches about Georgia highway and port reform, waiting for my chance to lay eyes on the Next Big Thing in person.

By the time Perry shows up, I’m jazzed and ready for history. You always want to remember the first time you see the possible next president in person. But as every young person knows, the first time is not always a pleasant experience. Perry lumbers onstage looking exceedingly well-groomed, but also ashen and exhausted, like a funeral director with a hangover.

In a voice so subdued and halting that I think he must be sick, he launches into his speech, which consists of the following elements: a halfhearted football joke about Texas A&M that would have embarrassed a true fan like George W. Bush, worn bromides about liberals creating a nanny state, a few lines about jobs in Texas, and a promise to repeal “as much of Obamacare as I can” on his first day in the White House.

Bank Customers Flee to CUs

An estimated 650,000 consumers have closed their bank accounts and opted for credit union membership over the past four weeks, according to CUNA, bringing the approach to Saturday’s Bank Transfer Day to a crescendo.

In a survey of 5,000 of its credit union members CUNA estimates that at least 650,000 consumers across the nation have joined credit unions since Sept. 29, the day Bank of America unveiled its now-rescinded $5 monthly debit card fee. Also during that time, CUNA estimates that credit unions have added $4.5 billion in new savings accounts, likely from the new members and existing members shifting their funds.

Click Here for Zippo Lighter Vintage, Sterling Silver, High Polish

Wall Street Isn’t Winning – It’s Cheating

I was at an event on the Upper East Side last Friday night when I got to talking with a salesman in the media business. The subject turned to Zuccotti Park and Occupy Wall Street, and he was chuckling about something he’d heard on the news.

“I hear [Occupy Wall Street] has a CFO,” he said. “I think that’s funny.”

“Okay, I’ll bite,” I said. “Why is that funny?”

“Well, I heard they’re trying to decide what bank to put their money in,” he said, munching on hors d’oeuvres. “It’s just kind of ironic.”

Oh, Christ, I thought. He’s saying the protesters are hypocrites because they’re using banks. I sighed.

“Listen,” I said, “where else are you going to put three hundred thousand dollars? A shopping bag?”

“Well,” he said, “it’s just, their protests are all about… You know…”

“Dude,” I said. “These people aren’t protesting money. They’re not protesting banking. They’re protesting corruption on Wall Street.”

“Whatever,” he said, shrugging.

These nutty criticisms of the protests are spreading like cancer. Earlier that same day, I’d taped a TV segment on CNN with Will Cain from the National Review, and we got into an argument on the air. Cain and I agreed about a lot of the problems on Wall Street, but when it came to the protesters, we disagreed on one big thing.

My Advice to the Occupy Wall Street Protesters

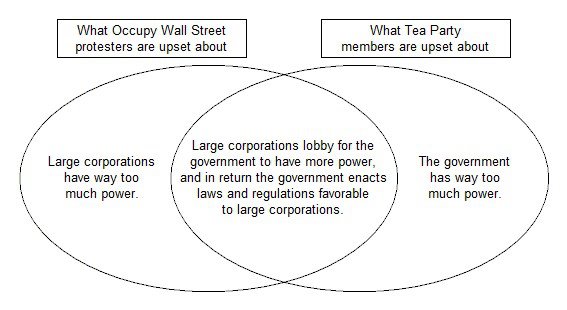

I’ve been down to “Occupy Wall Street” twice now, and I love it. The protests building at Liberty Square and spreading over Lower Manhattan are a great thing, the logical answer to the Tea Party and a long-overdue middle finger to the financial elite. The protesters picked the right target and, through their refusal to disband after just one day, the right tactic, showing the public at large that the movement against Wall Street has stamina, resolve and growing popular appeal.

But… there’s a but. And for me this is a deeply personal thing, because this issue of how to combat Wall Street corruption has consumed my life for years now, and it’s hard for me not to see where Occupy Wall Street could be better and more dangerous. I’m guessing, for instance, that the banks were secretly thrilled in the early going of the protests, sure they’d won round one of the messaging war.

Why? Because after a decade of unparalleled thievery and corruption, with tens of millions entering the ranks of the hungry thanks to artificially inflated commodity prices, and millions more displaced from their homes by corruption in the mortgage markets, the headline from the first week of protests against the financial-services sector was an old cop macing a quartet of college girls.

Mike Bloomberg’s Marie Antoinette Moment

“I hear your complaints,” Bloomberg said. “Some of them are totally unfounded. It was not the banks that created the mortgage crisis. It was, plain and simple, congress who forced everybody to go and give mortgages to people who were on the cusp. Now, I’m not saying I’m sure that was terrible policy, because a lot of those people who got homes still have them and they wouldn’t have gotten them without that.”

To me, this is Michael Bloomberg’s Marie Antoinette moment, his own personal “Let Them Eat Cake” line. This one series of comments allows us to see under his would-be hip centrist Halloween mask and look closely at the corrupt, arrogant aristocrat underneath.

Occupy Wall Street has not yet inspired many true villains outside of fringe characters like Anthony Bologna. But Bloomberg, with this preposterous schlock about congress forcing banks to lend to poor people, may yet make himself the face of the 1%’s rank intellectual corruption.

This whole notion that the financial crisis was caused by government attempts to create an “ownership society” and make mortgages more available to low-income (and particularly minority) borrowers has been pushed for some time by dingbats like Rush Limbaugh and Sean Hannity, who often point to laws like the 1977 Community Reinvestment Act as signature events in the crash drama.

Well, you know what, Mike Bloomberg? FUCK YOU. People are not protesting for their own entertainment, you asshole. They’re protesting because millions of people were robbed, by your best friends incidentally, and they want their money back. And you’re not everybody’s Dad, so stop acting like you are.

Jesse Ventura SLAMS FOX NEWS

The Inevitable Has Happened: Occupy Foreclosures

Last night Occupy Oakland’s General Assembly did something that is likely to catch on with occupations across the country.

They voted to encourage the occupation of foreclosed properties across their city. After all, the bursting of the property bubble is part of why they’re on the streets right now.

There is a movement similar to this under the overall Occupy umbrella, It’s called Occupy Vacant Properties, and it has been most visible in San Francisco, where families are even reclaiming their old homes post-foreclosures.

The Rest is Up to You…

Michael Porfirio Mason

AKA The Peoples Champ

AKA GFK, Jr.

AKA The Sly, Slick and the Wicked

AKA The Voodoo Child

The Guide to Getting More out of Life

http://www.thegmanifesto.com