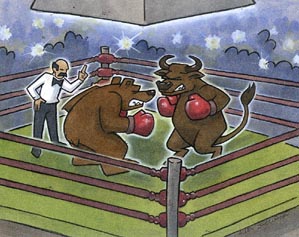

Bulls, Bears, Pigs and Sheep

Bulls, Bears, Pigs and Sheep

For May18th– May 22nd 2009

By: Matthew Bradbard

Click Here for Pit Bull: Lessons from Wall Street’s Champion Day Trader

You don’t need to go to the zoo to see animals, rather look at the common investor and how they maneuver within their portfolio. I’m not talking about giraffes and elephants but rather bulls, bears, pigs and sheep. Bulls make money in a bull market, bears make money in a bear market, pigs are greedy and will lose money in the long run, while sheep are led to the slaughter as they fail to do their own research and just follow the masses. It is crucial to one’s investment success to be able to maneuver and recognize changes in trends, to be disciplined, to eliminate fear and greed and to think outside the box. The current market dynamic is challenging and will remain this way for quarters and perhaps years. We suggest investors seek the help of professionals and if they truly are animal lovers watch the discovery channel, go to the zoo or get a pet, but do not invest like an animal.

To find out exactly how we are positioning our clients in commodity futures and options,

Contact us today at 1-888-920-9997. Don’t forget to tell them The G Manifesto sent you.

Energies

DOE reported crude oil supplies were down for the first time since February, but before energy bulls get excited, the rationale is less supply rather than more demand. July crude oil closed down 2.74 closing lower on the week after 3 positive weeks. We expect prices to move lower from over bought levels. Resistance is seen between $58.50 and $59 with support first at $56.30 followed by the 20 day moving average at $54.95. July heating oil lost 11.74 cents last week closing just above the 20 day moving average. Resistance comes in at 1.52 with support at 1.36, on a breach of that level prices should retrace to levels from 3 weeks ago near 1.31. July RBOB gave up 3.30 cents but did remain within a 10 cent trading range. Resistance is seen at 1.71 with support at 1.63 followed by 1.56. If crude is down $4-6 look for a trade to $1.40/1.45.

DOE reported underground supplies of natural gas were up 95 billion cubic feet last week to 2.013 trillion cubic feet. Supplies are now up 33% from a year ago. July natural gas ended down 22 cents after reaching a 6 week high. After the impressive $1.30 advance we would expect some back and fill action. We will be exploring mini futures and selling puts and buying calls for clients. Resistance is seen at $4.50 with support at $4.05 followed by $3.85. On July an ideal entry would be between 3.70 and 3.85.

Livestock

The USDA estimated the week’s beef production at 516.0 million pounds, down 5.7% from a year ago. The USDA expects beef production to be down slightly in 09’ and down 2% in 10’. Their average price estimate for choice steers is 86.5 cents per pound in 09’ and 90.5 cents per pound in 10’. June live cattle were lower by .325 last week. Support at .8100 with resistance at .8400. We would be a buyer/seller on a move out of that range. August feeder cattle were up 100 last week. Resistance at 102.25, support at 100.50.

Pork production was estimated at 424.4 million pounds, up 2.5% from a year ago. The USDA estimated that pork production will be down 3% in 09’ and down 0.5% in 10’. Their average price estimate for barrows and gilts is 45.5 cents/lb. (61.5 cents lean) in 09’ and 50 cents/lb. (67.5 cents lean) in 10’. June hogs closed down 1.775 last week. Support comes in between 65.25 and 65.75 while resistance is at 68.90. We’re still looking for 71+ and own 72 calls for clients; put limits to exit at 170 points, paid 90 points.

Financials

Stocks: The Dow suffered its second loss in 10 weeks to lose just over 300 points or 3.6% to 8269. The S&P had its worst week since early March giving up nearly 50 points or 5% to 883. The NASDAQ snapped a 9 week winning streak to lose 59 points or 3.4% to 1680. The media reports “green shoots”, I report “brown sh-ts” in terms of what is to come. We have cautioned investors about becoming too enamored with the most recent 35%+ rally and feel it has now run its course with more down to come. As consumers continue to spend less, as seen with last weeks’ retail sales and credit card defaults, increased fear will return to the marketplace. When a governor throws out the idea to sell off icons too raise money, you know things are rough. 900 should serve as resistance on the S&P and 8400 in the Dow, support at the 20 day moving average at 880 and 8200 respectively. On a breach of those levels 830 and 7800 would be our objectives.

Continue Reading about Bonds, Currencies and Grains

To view our full commentary which includes the sectors of energies, livestock, currencies, financials, grains, softs, and metals, subscribe to our 4 week free trial by visiting this link: http://mbwealth.com/subscribe.html.

_____________________________________________________________________________________Risk Disclosure: The risk of loss in trading commodity futures and options can be substantial. Before trading MB Wealth recommends that you should carefully consider your financial position to determine if commodity trading is appropriate for you. All funds committed should be purely risk capital. Past performance is no guarantee of future trading results. There are no guarantees of market outcome stated, everything stated above are our opinions. Calculations of profit and loss have not factored in commissions and fees.

No Comments on "Bulls, Bears, Pigs and Sheep"